Non-Profit Organizations, Ohio Law, and the Internal Revenue Code

4.5 (231) · $ 14.99 · In stock

The relationship and interaction between Ohio law governing not-for-profit organizations and the Internal Revenue Code provisions governing tax-exempt and charitable organizations can be confusing and often misunderstood. Many people assume that one necessarily means the other, which is not the case.

Charity Registration - CHARITABLE OHIO

Financial Reports - Institute for Justice

Nonprofit Governance by State, Harbor Compliance

501(c)(3) Rules and Regulations To Know

:max_bytes(150000):strip_icc()/not_for_profit_nonprofit_charity_AdobeStock_93906620-c07fd22b87c84bf28cf8b9caba9a1b67.jpeg)

5 Steps to Forming a 501(c)(3) Nonprofit Corporation

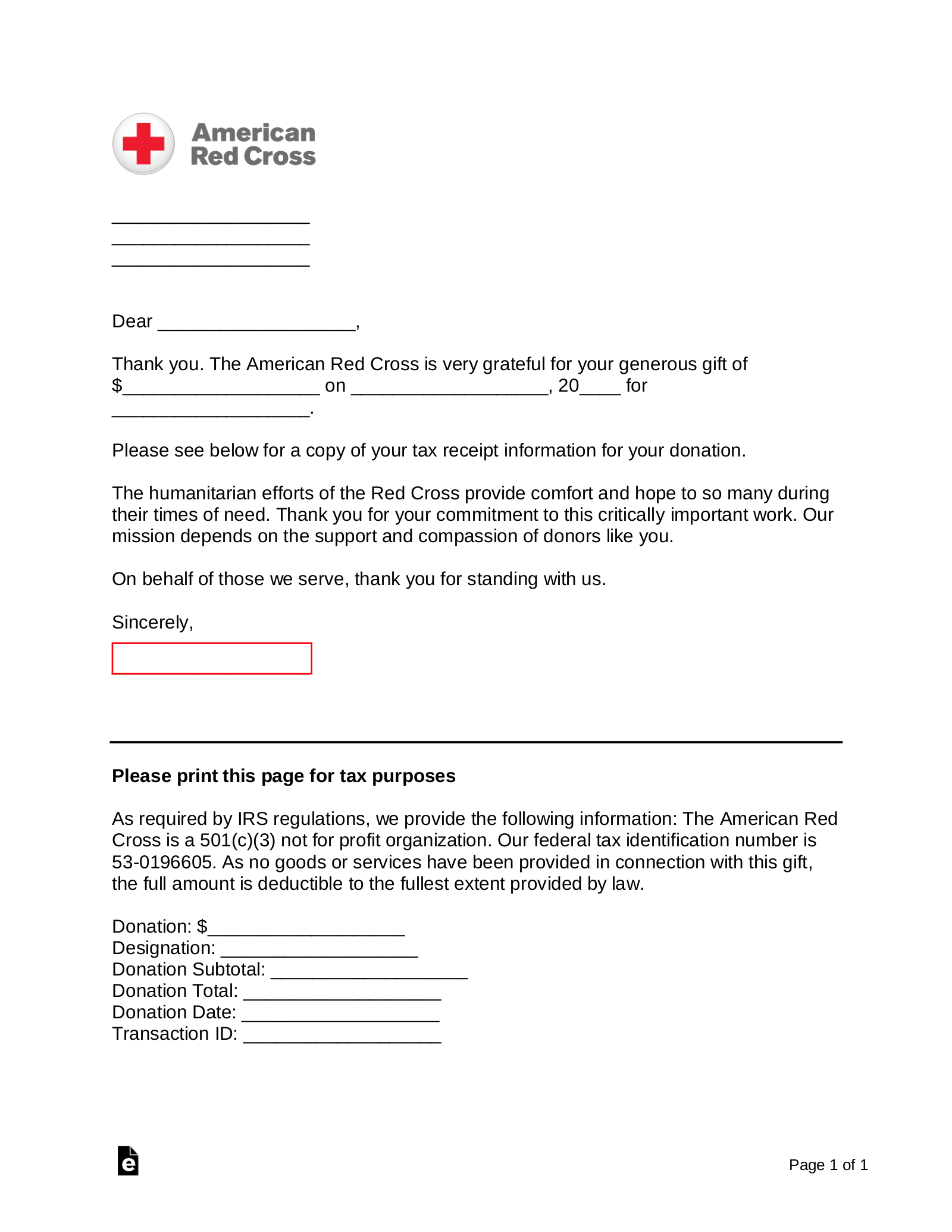

Free American Red Cross Donation Receipt Template - PDF

Most Common Lawsuits for Nonprofits - Emplicity PEO & HR Outsourcing

Good Neighbors Guidelines English and Spanish - Good Neighbors, Inc.

Pass-Through Entities & Fiduciaries - Withholding Tax Return (IT 1140)

What are Taxable Gross Receipts Under Ohio's Commercial Activity Tax?

Charitable Gaming - CHARITABLE OHIO