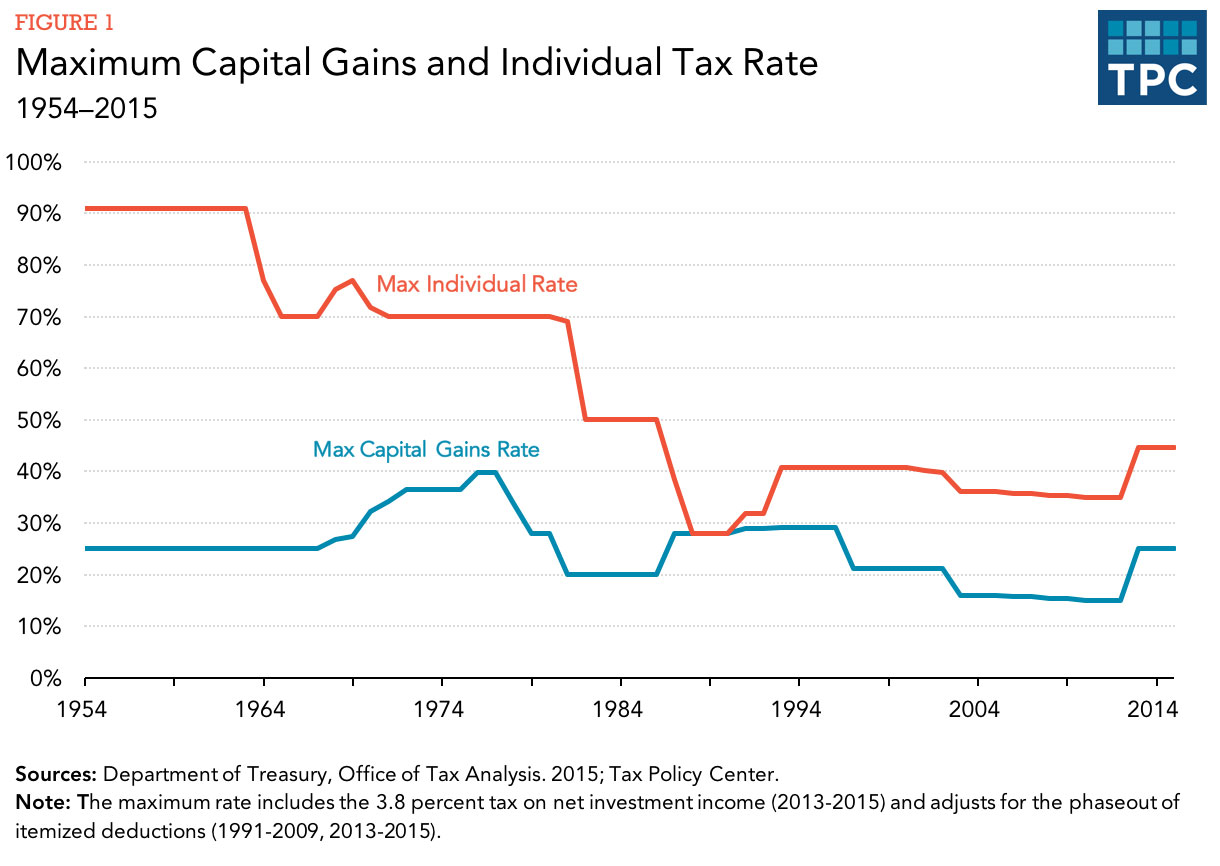

Capital Gains Tax: What It Is, How It Works, and Current Rates

4.8 (483) · $ 8.50 · In stock

A capital gains tax is a levy on the profit that an investor makes from the sale of an investment such as stock shares. Here

:max_bytes(150000):strip_icc()/taxgainlossharvesting.asp-final-00d62f57a67b4b2aa66d7f90d7e60126.png)

Capital Gains Tax: What It Is, How It Works, and Current Rates

:max_bytes(150000):strip_icc()/returnofcapital.asp-final-e81e1adae6ed454694a89a15d6590b88.png)

Return of Capital (ROC): What It Is, How It Works, and Examples

Capital Gains Tax Explained: What It Is and How Much You Pay

How Capital Gains Tax Works In Canada – Forbes Advisor Canada

Stock Market Capital Gains Tax Sales

How to File Income Tax Return For Salaried Employee

The Long Term Capital Gains Tax is Lower Than the Short Term Capital Gains Tax - Fact or Myth?

Capital Gains Tax: What Is It & When Do You Pay It?

What Is Cost Basis? How It Works, Calculation, Taxation, and Example

Capital Gains vs. Ordinary Income - The Differences + 3 Tax Planning Strategies - Kindness Financial Planning

Anna Summitt (@Indyanna63) / X

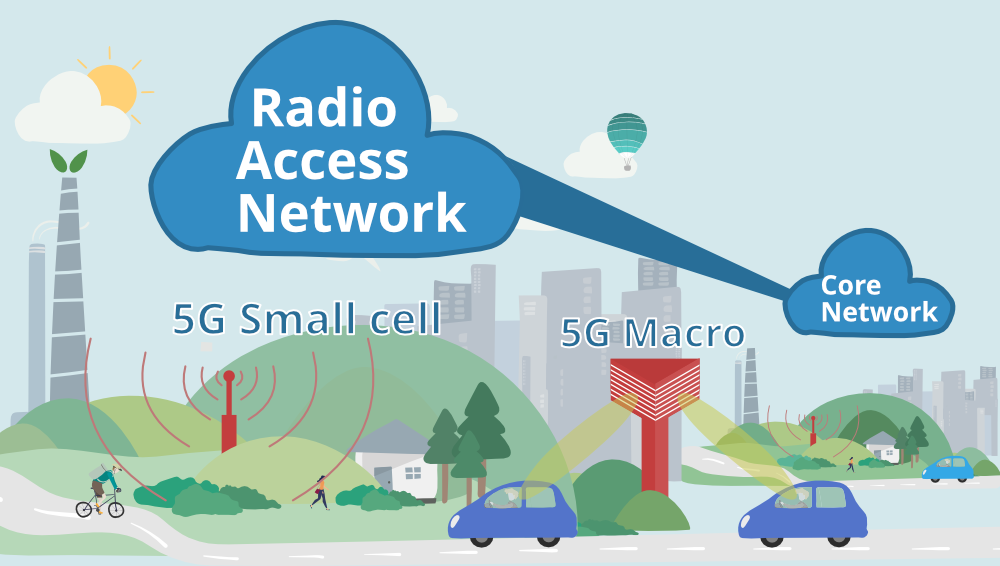

What is 5G Wireless Technology and How it Works? - GeeksforGeeks

Mechanics Of The 0% Long-Term Capital Gains Rate

2024 State Income Tax Rates and Brackets

California State Taxes: What You Need To Know

:max_bytes(150000):strip_icc()/capital_gains_tax.asp-Final-2add8822d04c4ea694805059d2a76b19.png)